MA coverage is extended for an individual who becomes ineligible for SSI because of special circumstances. The CAO will determine whether any of the situations listed in this Chapter applies when SSI is closed, when an individual applies for MA, or when MA is renewed.

If an individual is eligible for continued MA under one of the "Special SSI MA” categories discussed in this section, the CAO will approve MA in an SSI-related category (PA, PJ, or PM).

When an individual is determined eligible for one of the “Special SSI MA” categories, eCIS will automatically send a notice after processing. Copies of the notices may be found in Appendix C, SSI Form Letters and Notices.

The Pickle amendment, as expanded by the Lynch v. Rank court decision, provides for the disregard of Social Security Title II RSDI cost-of-living increases when an individual who is entitled to both SSI and RSDI is found ineligible for SSI because of the receipt of, or increase in, the RSDI income. The CAO must determine the individual’s eligibility for MA as it would for any other SSI individual, but it must not count the amount of the RSDI COLA that caused the SSI to terminate nor any additional RSDI COLAs that the individual received since the SSI closure. Eligibility for continued or restored MA under the Pickle Amendment is determined using the RSDI benefit amount the individual was entitled to in the last month of SSI eligibility.

NOTE: The CAO will count any increases in RSDI that were given for reasons other than a COLA.

To qualify for continued or restored MA under the Pickle amendment, all of the following conditions must be met:

The individual currently gets Social Security Title II RSDI benefits.

The individual was entitled to Social Security Title II RSDI and SSI at the same time in any month after April 1977.

SSI benefits were stopped after April 1977due to receiving an RSDI COLA that caused them to no longer be financially eligible to receive the benefit

OR

The individual received SSI while their RSDI was being calculated and then lost the SSI when the RSDI turned out to be higher than the SSI income limit at the time. Now, the individual’s RSDI income (minus the COLAs received) is below the current SSI income limit.

The individual would be eligible for SSI if the Social Security Title II COLAs were not counted.

The Social Security Administration (SSA) has given DHS a file of individuals who were entitled to SSI and Social Security benefits at the same time and whose SSI benefits were stopped after April 1977. The individuals listed on the file might be eligible for continued or restored MA as a “Special SSI MA Recipient” under the Pickle amendment. The information is available for the CAO to review on DocuShare and in Management Reporting in the EDW. The file is updated annually. The CAO must access the file for information if a former SSI recipient applies for benefits or if the CAO identifies an individual as potentially meeting “Special SSI MA Recipient” status under the Pickle Amendment.

The file includes lead information about the individual’s approximate SSI termination date and Title II (RSDI) benefit amount at the time the individual lost SSI entitlement.

To access this file, you may open it one of two ways.

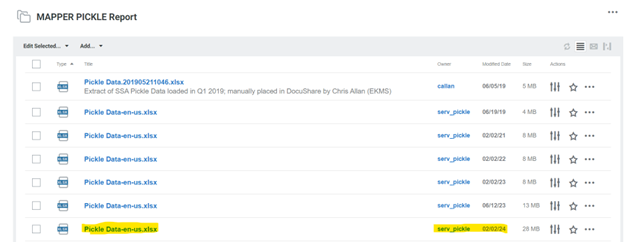

1) Access DocuShare; the folder “MAPPER PICKLE Report” is on the landing page under “Other Collections:” see the screenshot below.

Open the Pickle Data excel spreadsheet with the most recent modified date.

OR

2) Sign into the EDW’s Management Reporting, using CWOPA credentials. The file is located under the following path: Public Folders>Income Maintenance>SSA Pickle Data Reporting Package. Once the package has been entered a landing page will be visible, the CAO can view or filter information using the individual’s claim account number, name and other search criteria (see below).

To populate all individuals on the Pickle Report, do not select any filter criteria and click the “finish” button toward the bottom left-hand corner of the window.

NOTE: If researching more than two individuals at one time, export the report to an excel or csv file to ensure all the individuals’ records are captured.

If an individual receives Title II Social Security benefits, the CAO will review Exchange 6 to determine whether the individual received SSI in the past. The CAO will also review the case record to determine if the individual was ever open in an SSI MA budget (A, M or J). If needed, the CAO will ask the individual whether they ever received SSI. If the individual meets the conditions above, the CAO will determine the individual’s eligibility for PA, PJ, or PM as follows:

Access the most recent MAPPER Pickle Report or review the SSA Pickle Data EDW report and determine if the individual is included on the file.

If the individual is listed on the file, use the data elements on the file as a lead to further review for continued or restored MA under the Pickle Amendment.

Use the data element “Termination Date Calendar Date” as the starting point in reviewing historical “8036 Pend” Exchange 6 and Exchange 3 files to determine if an RSDI COLA caused the individual’s SSI to terminate. In addition, determine if the individual received SSI payments (as either a one-time lump sum or as monthly payments) that terminated once the individual started receiving RSDI income.

Obtain the current gross monthly Title II Social Security RSDI income from Exchange 3, BENDEX Master Benefit Record Match Summary and Details screens.

Determine the gross amount of the Title II Social Security RSDI that allowed the individual to be financially eligible for and concurrently receive SSI.

OR

Determine the monthly gross amount of the Title II Social Security RSDI first received immediately after the SSI terminated.

NOTE: The CAO may need to review Exchange 3 and Exchange 6 historical records to determine the amount and point in time the Title II RSDI COLA or the new RSDI monthly income caused the individual to exceed the SSI payment level for that year, causing the SSI to terminate.

Determine the amount of the Title II Social Security RSDI COLA the individual received that caused the SSI to terminate and/or the amounts of any subsequent COLAs the individual has received to date since the SSI terminated.

Review SSA’s COLA chart to determine the percent increase the individual received that year and any following years to date.

Take the prior year’s gross Title II Social Security RSDI amount that allowed the individual to remain financially eligible for SSI or the amount of the Title II RSDI received immediately after the SSI terminated and multiply by the following year’s COLA percentage increase to get the amount of the COLA increase.

For subsequent years, take the prior year’s gross Title II Social Security RSDI amounts and multiply by the following year’s COLA percentages to get the amounts of the COLA increases.

Use historical 4th quarter Exchange 3 records for each year being determined for further assistance in determining the actual COLA amount the individual received, to account for rounding.

The COLA updates are typically received in November of each year.

Add all COLA amounts together to get the total COLA amount the individual has received.

Subtract the total COLA amount from the current gross Title II Social Security RSDI benefit.

Add any other income (unearned and earned).

NOTE: Other income includes, but is not limited to, Railroad Retirement, trust funds, Sheltered Workshop wages, and VA benefits.

Allow the SSI unearned and earned income deductions found in MAEH 360.3 Deductions-SSI-related, including the $20 disregard.

Create the Past SSI/RSDI screen in eCIS for all cases in which MA eligibility is being reviewed under the Pickle Amendment. Creation of this screen ensures the system reviews for the “Special SSI MA” budget as part of the MA cascade. The following fields must be completed:

Individual name:

SSI Begin:

SSI End:

Loss/Denied Reason: 2-COLA increase of RSDI (Pickle)

Verification:

RSDI Receipt: Y-YES

RSDI Income before SSI loss:

Enter the amount of the current gross Title II Social Security RSDI income reduced by the total COLA amount received by the individual since the SSI terminated.

This is generally the last RSDI payment amount received before the COLA caused the SSI to terminate OR the first RSDI payment amount received IMMEDIATELY AFTER the SSI terminated.

RSDI Begin:

The date entered must be a least one full month prior to the date entered for the “SSI End” field.

Example: If the date entered on the “SSI End” field is 12/15, the date entered for the RSDI Begin field must be no later than 11/15.

Determine the individual’s countable resources

Run eligibility in eCIS

The individual will continue MA in the Pickle Amendment budget if the individual’s countable income after excluding the total COLA amount is the same as or less than the current SSI payment level for an individual or couple in living arrangement A found in MAEH 387 Appendix A and if their resources are below the SSI limits. Close the SSI MA budget (A, J, or M) or the current MA category and approve PA, PJ, or PM with program status code 84. eCIS will determine a renewal date of twelve months from the approval date.

If the individual is not open in MA, authorize the individual in the “Special SSI Recipient” status- Pickle Amendment budget.

If the individual is eligible for Medicare, DHS will pay the individual’s Medicare premium.

If the individual’s countable income after excluding the total COLA amount is more than the current SSI payment level for an individual or couple in living arrangement A found in MAEH 387 Appendix A or they are over the SSI resource limit, then the individual is not currently eligible for continued or restored MA under the Pickle Amendment. Determine whether the individual is eligible for Healthy Horizons, MAWD, MAGI, MNO or Buy-in programs.

NOTE: Do not delete the Past SSI/RSDI screen if the individual does not currently financially qualify for the Pickle Amendment budget.

Example: Susie, age 46, applies for MA in 2024 and notes on the application that they receive Title II RSDI income and received SSI in the past. The CAO reviews Susie for potential MA eligibility in the “Special SSI Recipient” Status under the Pickle Amendment as follows:

The CAO reviews the current MAPPER Pickle report and finds that Susie is on the list.

A review of Exchanges 3 and 6 show that Susie’s SSI terminated at the end of March 2018 due to the entitlement of new RSDI income in the same month. Susie started receiving the monthly RSDI income in April 2018, the month after entitlement.

The CAO completes the Past SSI/RSDI screen in eCIS.

Susie's RSDI income in 2024 is in the amount of $1,037.00 per month.

Susie received $825 in April 2018, the month after their SSI terminated.

The CAO reviews SSA’s COLA chart to obtain the percent increase for each subsequent year and determines each year’s COLA amount. The CAO reviews 4th quarter records on Exchange 3 to account for the rounding. Then the CAO adds each year’s COLA amount together.

|

COLA Amount Calculation |

|||

|

Year |

COLA % |

Previous Year's Title II Income X COLA % |

COLA Amount (rounded) |

|

2019 |

2.8% |

$825 X .028 |

$23 |

|

2020 |

1.6% |

$848 X .016 |

$14 |

|

2021 |

1.3% |

$862 X .013 |

$11 |

|

2022 |

5.9% |

$873 X. 059 |

$52 |

|

2023 |

8.7% |

$925 X .087 |

$80 |

|

2024 |

3.2% |

$1005 X .032 |

$32 |

|

Total COLA Received Through 2024 |

$212 |

||

|

2025 |

2.5% |

$1037 X .025 |

$26 |

The CAO subtracts Susie’s 2024 Title II RSDI monthly income of $1,037 and subtracts the $212 total COLA they received to date and determines the amount to be $825.

Susie does not receive any other income and her resources are within SSI limits.

The CAO allows the $20 disregard on the $825 RSDI amount.

Susie’s countable RSDI income of $805 is less than the SSI payment level of $965.10 in 2024. The CAO authorizes Susie in PJ84.

When the CAO receives an Exchange 6 disposition reason code hit indicating that an individual is no longer receiving SSI, the CAO will:

Determine the reason the SSI terminated.

Determine continued MA eligibility under the Pickle Amendment using the above steps, if SSI terminated because of the individual receiving a Title II RSDI COLA or if SSI terminated upon the receipt of Title II RSDI income.

Send a confirming notice to stop MA in the SSI category.

Approve MA in the “Special SSI Recipient” status- Pickle Amendment category (PA, PJ, or PM with program status code 84) if eligible. The effective date is the day after the closing date of SSI MA benefits.

Send the individual a notice of eligibility for their new MA category.

Send advance notice, if the individual is not eligible for MA.

Review the individual’s eligibility if a change takes place because of any of the following:

An increase in the individual’s income other than from a COLA.

An increase in the individual’s resources.

A change from individual to couple status.

A Disabled Adult Child (DAC) is an individual age 18 or older, who became disabled or blind before the age of 22, and who receives Title II Social Security child’s benefits as a survivor or dependent under the earnings record of a parent or guardian. The parent or guardian of the DAC must either be deceased or receiving SSA retirement or disability benefits.

A DAC may have received SSI and upon receiving the new Title II Social Security benefit or an increase in the Title Social Security benefit, lost their eligibility to continue to receive SSI.

In these cases, the individual must be reviewed for MA in a “Special SSI” DAC budget (PA, PJ, or PM with program status code 81). Section 1634(c) of the Social Security Act requires States to consider DACs who solely lose SSI eligibility due to the new or increased Title II Social Security benefit as still being SSI recipients for MA eligibility purposes. The individual is eligible for “Special SSI MA” in the DAC budget as long as the individual would still have been eligible to continue to receive SSI if the new or increased Title II Social Security benefits had not been counted and the individual meets the rest of the MA eligibility criteria for a DAC.

A DAC may be identified in any one of three ways:

When SSI is terminated for a DAC, the Medicaid Eligibility Code on the MA/FS Tab on Exchange 6 will change from a “Y”- Eligible for Medicaid to a “D”- Disabled Adult Child.

A letter “C” (for child) will be included at the end of their Social Security claim number. The claim number will not be the DAC’s Social Security number, but will be their parent or guardian’s number. If the CAO suspects an adult MA applicant or recipient may be a DAC, the CAO should review Exchange 3 to see if they are receiving Title II Social Security as a child’s benefit.

The CAO should review MA eligibility history in eCIS to determine if they were ever open in an SSI budget. If MA eligibility history shows the individual’s SSI budget closed and a DAC budget opened the next day the individual is likely a DAC and should be reviewed for DAC MA eligibility.

387.621 Determining DAC Eligibility and Authorizing Benefits

Most DAC cases are systematically authorized, but some DAC cases will exception out of the automated process and need opened manually.

Automated DAC Openings:

When SSI terminates for the DAC, SSA sends DHS an updated Exchange 6 “8036 Pend” record that shows the SSI record closed. In most cases, the system automatically closes the SSI budget and opens the DAC budget within a few days of receiving the updated Exchange 6 record.

In order to go through the Auto DAC process:

The individual must be 18 years of age or older.

The individual must be open in an SSI budget that is not PSCs 60 and 62 and the SSI budget must have no end date.

The Medicaid Eligibility code on Exchange 6 must be set to “D”-Disabled Adult Child.

There must be no demographic mismatch between eCIS and the Exchange.

DAC cases that are auto processed are reported in each CAO’s DAC10WR01- DAC Automated Openings-WEEKLY folder in Docushare. To access the folder, designated CAO staff should go to:

Mainframe Reportsà CAOsà Select their Specific CAOà Navigate to the DAC10WR01 folder

DAC cases that are auto processed are to be reviewed within three months to determine continued MA eligibility. The CAO worker will receive a DAC 047 alert on their Workload Dashboard (WLD), which is due within 90 days of creation, and can be cleared once the worker completes the continued MA eligibility review.

Manual DAC Openings:

Some DAC cases exception out of the auto-DAC authorization process and the CAO will need to manually close the SSI budget, if one was opened, and review for eligibility in a DAC budget.

DAC cases that need to be processed manually are reported in each CAO’s DAC05DR01-DAC Exception Report-DAILY folder in DocuShare. To access the folder, designated CAO staff should go to:

Mainframe Reportsà CAOsà Select their Specific CAOà Navigate to the DAC05DR01 folder.

CAOs should review this folder once a week to determine if a DAC case requires manual processing.

To review the individual’s continued eligibility in the “Special SSI MA” DAC budget, the CAO will:

Determine the gross amount of the Title II Social Security benefit that allowed the individual to be financially eligible for and concurrently receive SSI before the amount increased, which caused the SSI to terminate.

This amount may be zero if the individual did not receive any Title II Social Security benefit while financially eligible for SSI.

There may be some overlap in dates from when the new or increased Title II benefit is being received and when the SSI terminates.

CAO workers may need to review Exchange 3 and/or Exchange 6 historical records to determine at what amount and point in time the Title II Social Security benefit caused the individual to exceed the SSI payment level and the SSI to terminate.

Exchange 3-The Bendex Master Benefit Record Match Summary is helpful to see the change in the Title II benefit amount and the approximate timeframe of when that change occurred.

Exchange 6- The Income Tab is helpful to determine the amount of the new Title II income that caused the SSI to terminate, especially if Exchange 3 information is not available yet.

Add any other income (unearned and earned).

NOTE: Other income includes, but is not limited to, Railroad Retirement, trust funds, Sheltered Workshop wages, and VA benefits.

Allow the SSI unearned and earned income deductions found in MAEH 360.3 Deductions-SSI-related, including the $20 disregard.

Create the Past SSI/RSDI screen in eCIS for all DAC recipients who lost SSI entitlement upon the receipt of or increase in the Title II Social Security child’s benefit. Creation of this screen will ensure the system reviews for the DAC budget as part of the MA cascade. The following fields must be completed:

Individual Name:

SSI Begin:

SSI End:

Loss/Denied Reason: 3-Either increase or receipt of RSDI Title II benefits (DAC)

Verification:

RSDI Receipt:

RSDI Income before SSI Loss*:

This amount may be zero if the individual did not receive Title II income while financially eligible for SSI.

If the individual received a smaller Title II income and then receives an increase in the amount that exceeds the SSI payment level, only enter the amount of the smaller Title II income they received that allowed the individual to remain financially eligible to receive SSI.

RSDI Begin:

Determine the individual’s countable resources.

Run Eligibility in eCIS

The individual will continue MA in the DAC budget (PA, PM, or PJ with program status code 81) if the individual’s countable income and resources are at or below the current SSI payment limits for an individual or couple in living arrangement A found in MAEH 387 Appendix A.

NOTE: If a DAC is receiving Medicare Part B, the individual is eligible for Buy-in.

If a DAC is in a Home and Community Based Services (HCBS) program, the individual is to remain in the DAC budget with the applicable waiver code entered. In most cases, the system changes to the waiver category instead of remaining in the DAC budget. When this occurs, the CAO needs to perform a manual non-financial override to change the categoryback into the DAC budget. Steps to complete this process are outlined in the HCBS Procedural Desk Guide.

If the individual is in a Long-Term Care (LTC) facility, the budget must change to PAN, PJN or PMN. The CAO is to enter a flagged case comment that the individual is a DAC. If the individual is released from the LTC facility, the CAO should change the individual’s MA category back to the DAC budget.

In addition, any future increases in the Title II Social Security child’s benefits are not counted as income for MA eligibility in the DAC budget.

If the individual’s countable income and resources are above the current SSI limits, review the individual for other MA categories.

NOTE: Do not delete the Past SSI/RSDI screen if the individual does not currently financially qualify for the DAC budget.

Send a renewal form and/or pending verification form if additional information is needed to determine ongoing eligibility. If the individual is not eligible for MA, send advance notice.

Example One: Mary receives SSI in the amount of $97 and a Title II Social Security child’s benefit of $866 each month. On 1/3, SSA sends DHS an updated Exchange 6 file showing SSI is terminating due to countable income exceeding the Title XVI (SSI) payment amount, with the month of change occurring in February. On 1/4, the case goes through the Auto-DAC process by which the system automatically closes the individual’s SSI budget and opens a DAC PJ81 budget effective 2/1. The CAO worker receives a DAC 047 alert on their dashboard to review the individual for continuing MA eligibility. When reviewing the case, the CAO worker reviews Exchange 3 and determines that the individual’s Title II Social Security child’s benefit increased to $1,120 per month. The CAO worker completes the Past SSI/RSDI screen in the case record and reviews their income eligibility to remain in the DAC budget. Mary’s countable income of $846 per month is below the SSI Payment level of $965.10 in 2024. Mary is income eligible to remain in the DAC budget.

|

DAC Budget Income Eligibility Review |

|

|

Title II Income |

$866.00 |

|

Other Unearned Income |

$0 |

|

Other Earned Income |

$0 |

|

Unearned Income Deduction |

($20.00) |

|

Countable Income |

$846.00 |

|

2024 SSI Payment Level |

$965.10 |

Example Two: John receives SSI in the amount of $943 each month. On 1/3, he provides verification to the CAO his SSI will end and that he will receive RSDI in the amount of $1,300 per month effective 2/1. Since he does not receive Medicare and his $1,300 per month income exceeds the Healthy Horizons income limit of $1,255 in 2024, the CAO transitions John into the MG 91 category. On 1/6, SSA sends DHS an updated Exchange 6 file that SSI is terminating due to countable income exceeding the Title XVI payment amount, with the month of change occurring in February. The case exceptions out of the auto-DAC process because John was not in an SSI budget when the updated file was received. His case is reported on the CAO’s DAC05DR01-DAC Exception Report-DAILY folder in Docushare later that day. The CAO reviews his case, including information on Exchange 3 and 6, and determines the RSDI he will be receiving is a Title II Social Security child’s benefit and that he must be reviewed for MA eligibility in the DAC budget. The CAO worker completes the Past SSI/RSDI screen in the case record and reviews his income.

John’s countable income of $0.00 per month is below the SSI Payment level of $965.10 in 2024. John is income eligible for MA in the DAC budget.

|

DAC Budget Income Eligibility Review |

|

|

Title II Income |

$0 |

|

Other Unearned Income |

$0 |

|

Other Earned Income |

$0 |

|

Unearned Income Deduction |

$0 |

|

Countable Income |

$0 |

|

2024 SSI Payment Level |

$965.10 |

In SDX, a payment status code of N01 or E01 with a Medicaid Eligibility Code of “D” may generate an Exchange 6 disposition reason code 01 (Non-payment of SSI benefits to a Disabled Adult Child (DAC) hit if an individual potentially meeting DAC criteria is not authorized in a DAC budget. The Exchange hit alert must be reviewed and cleared by the CAO. The CAO is to also review the individual’s eligibility in the DAC budget per the steps indicated above. The CAO may need to contact the local Social Security office for assistance in determining the individual’s eligibility for continuing MA benefits.

NOTE: See Section 387.53, End of SSI MA Benefits, for instructions on reviewing eligibility.

"Special SSI MA Recipient” status is given to a disabled or blind individual who is not eligible for SSI because of their earnings from employment the Social Security Administration (SSA) refers to these individuals as, “1619(b) Eligibles.” The SSA makes the MA eligibility determination for these “Special SSI Recipients”. An individual with this status remains eligible for MA and Buy-In.

Individuals who are given “Special SSI MA Recipient” status must be treated as full SSI recipients (A/J/M) when determining eligibility for other household members for other MA programs. These household members and their income and resources are, therefore, excluded from the decision.

When the CAO receives an Exchange 6 hit, “Reason Code 04-Active A, J, M in CIS, Not found on SDX master file,” the CAO will review the SDX payment status and Medicaid eligibility code on the “8036 Pend” file. When the MA Eligibility Code on the MA/FS tab on the file is set to “C-Federally administered Medicaid coverage should be continued regardless of payment status code (1619b)”, this identifies the individual as meeting the “1619b Eligible Special SSI Recipient” Status. In this situation, the CAO will:

1. Close MA in the SSI category.

2. Open MA in the SSI-related category (PJ, PA or PM with program status code 85) effective the day after the SSI budget is closed.

Important: When the Medicaid Eligibility Code on Exchange 6 is set to “C”, MA is continued no matter the payment status code.

Create the Past SSI/RSDI screen for the individual in eCIS to ensure the system builds the Special SSI “1619b Eligible” budget. The following fields must be completed on the Past SSI/RSDI screen:

Individual Name:

SSI Begin:

SSI End:

Loss/Denied Reason: 5-Lost SSI due to increase in earnings (Disabled Employment)

Verification:

NOTE: If the individual received RSDI while they received the SSI, the RSDI fields should be entered on the screen. The fields names are listed below:

RSDI Receipt

RSDI Income before SSI Loss:

RSDI Begin:

3. Send the individual a notice of eligibility.

4. Keep the “Special SSI 1619b Eligible” budget open until SSA notifies DHS via an Exchange 6 “8036 Pend” file that Special SSI Recipient status has ended. The Medicaid Eligibility Code will change from a “C” to an “R” when SSA determines the individual no longer meets “Special SSI 1619b Eligible” Status. The individual must be reviewed for other “Special SSI MA” categories and other MA before being closed.

NOTE: Individuals eligible in the “Special SSI 1619 Eligible” category are not subject to a renewal.

“Special SSI MA Recipient” status is given to certain disabled widows and widowers who lost SSI eligibility because of the receipt of Social Security Title II Widow or Widower’s RSDI benefits. Individuals who are given “Special SSI MA Recipient” status must be treated as full SSI recipients (A/J/M) when determining eligibility for other household members for other MA programs. These household members and their income and resources are, therefore, excluded when determining MA eligibility for the individual with “Special SSI MA Recipient” status from the decision.

To qualify as a disabled widow or widower, an individual must meet all of the following conditions:

The individual is at least 50 years old and under 65 years old.

The individual must get widow's or widower's RSDI benefits.

The individual cannot get Medicare Part A benefits.

The individual lost SSI entitlement because they started to receive widow’s or widower’s Social Security Title II benefits

The individual’s resources are within the SSI resource limit.

When Social Security Title II widow or widower’s benefits are not counted, the individual’s income is less than the current SSI payment level.

NOTE: The law providing MA coverage for disabled widows or widowers who lose SSI (42 U.S.C. § 1383c(d)) specifies that Medicaid coverage applies if the widow or widower is eligible for Social Security benefits under 42 U.S.C. §§ 402(e) or (f). One of the requirements under those sections is that the individual’s disability start date must have begun before the end of a special period, which is within 84 months (seven years) of one of the following:

1. The spouse's death.

2. The last month in which they were eligible for mother's or father's survivor benefits.

3. The last month in which they were previously determined ineligible for Widow(er)'s coverage due to the end of their disability.

SSA contacts these individuals and lets them know by letter about their possible MA eligibility. SSA tells these individuals to contact the CAO to apply for MA.

The following information will be on the Exchange 6 “8036 Pend” file:

The Medicaid eligibility code on the MA/FS tab is set to “W-Widow(er)

Payment status code N01

New right to get Title II Social Security Widow or Widower’s benefits

The individual’s Title II Social Security claim number for the Widow or Widowers benefits will either have a “D-Aged Widow(er), age 60 or over” or a “W-Disabled widow(er), age 50 or over” at the end of it.

When an individual who may be eligible contacts the CAO or when the CAO receives an Exchange 6 hit or alert that indicates an individual is no longer eligible for SSI, the CAO will review the individual’s case and determine whether they can continue to receive MA under the “Special SSI MA Recipient” status of “Disabled Widow or Widower”. The CAO will:

1. Determine whether the individual is eligible under the above conditions and the financial rules for SSI-related MA

Review the Medicaid Eligibility and Payment Status Codes on the “8036 Pend” file from Exchange 6.

NOTE: A Medicaid Eligibility Code of “W- Widow(er)” designates that the individual may meet “Disabled Widow or Widower Special SSI MA Recipient” status.

Determine the gross amount of the Title II Social Security benefit the individual received that allowed the individual to be financially eligible for and concurrently receive SSI before the receipt of the Title II RSDI Widow or Widower’s benefit, which caused the SSI to terminate.

This amount may be zero if the individual did not receive any Title II Social Security benefit while financially eligible for SSI.

There may be some overlap in dates from when the new Title II RSDI widow or widower’s benefit is being received and when the SSI terminates.

CAO workers may need to review Exchange 3 and/or Exchange 6 historical records to determine at what point in time did the receipt of the of the Title II RSDI widow or widower’s benefit cause the individual to exceed the SSI payment level causing the SSI to terminate.

Exchange 3-The Bendex Master Benefit Record Match Summary is helpful to see the new claim number, the change in the total Title II benefit amount being received and the approximate timeframe of when that change occurred.

Exchange 6- The Income Tab is helpful to determine the amount of the new Title II Widow or Widower’s benefit that caused the SSI to terminate.

Add any other income (unearned and earned).

NOTE: Other income includes, but is not limited to, Railroad Retirement, trust funds, Sheltered Workshop wages, and VA benefits.

Allow the SSI unearned and earned income deductions found in MAEH 360.3 Deductions-SSI-related, including the $20 disregard.

Create the Past SSI/RSDI screen in eCIS for all individuals being reviewed for eligibility in the Disabled Widow or Widower’s budget. Creation of this screen will ensure the system reviews for the Disabled Widow or Widower’s budget as part of the MA cascade. The following fields must be completed:

Individual Name:

SSI Begin:

SSI End:

Loss/Denied Reason: 4-Lost SSI due to receipt of RSDI Title II benefits (Disabled Widow(er)

Verification:

RSDI Receipt:

RSDI Income before SSI Loss:

This amount may be zero if the individual did not receive Title II income while financially eligible for and receiving SSI payments.

If the individual received a smaller Title II income before starting to receive a Title II RSDI widow or widower’s benefit that exceeded the SSI payment level, only enter the amount of the smaller Title II income received that allowed the individual to remain financially eligible to receive SSI.

RSDI Begin Date:

Determine the individual’s countable resources.

Run Eligibility in eCIS

The individual will continue MA in the Disabled Widow or Widower’s budget (PJ with PSC 83) if the individual’s income (excluding the Title II RSDI widow or widower’s benefit) and resources are at or below the SSI limits for an individual in living arrangement A found in MAEH 387 Appendix A.

If the individual’s current countable income and resources are above the SSI limits, review the individual for other MA categories.

NOTE: Do not delete the Past SSI/RSDI screen if the individual does not currently financially qualify for the Disabled Widow or Widower’s budget.

2. Create a thorough narrative that includes the individual is a “disabled widow” or “disabled widower” in the eCIS case comments.

3. Review the case for continued MA, such as Healthy Horizons, MAWD, NMP, or MNO or for the Medicare cost-sharing and Buy-In programs when the individual becomes eligible for Medicare Part A.

4.Send advance notice to close if the individual is not eligible for MA.

NOTE: See Section 387.53, End of SSI MA Benefits, for more information.

Updated January 27, 2025, Replacing May 14, 2024